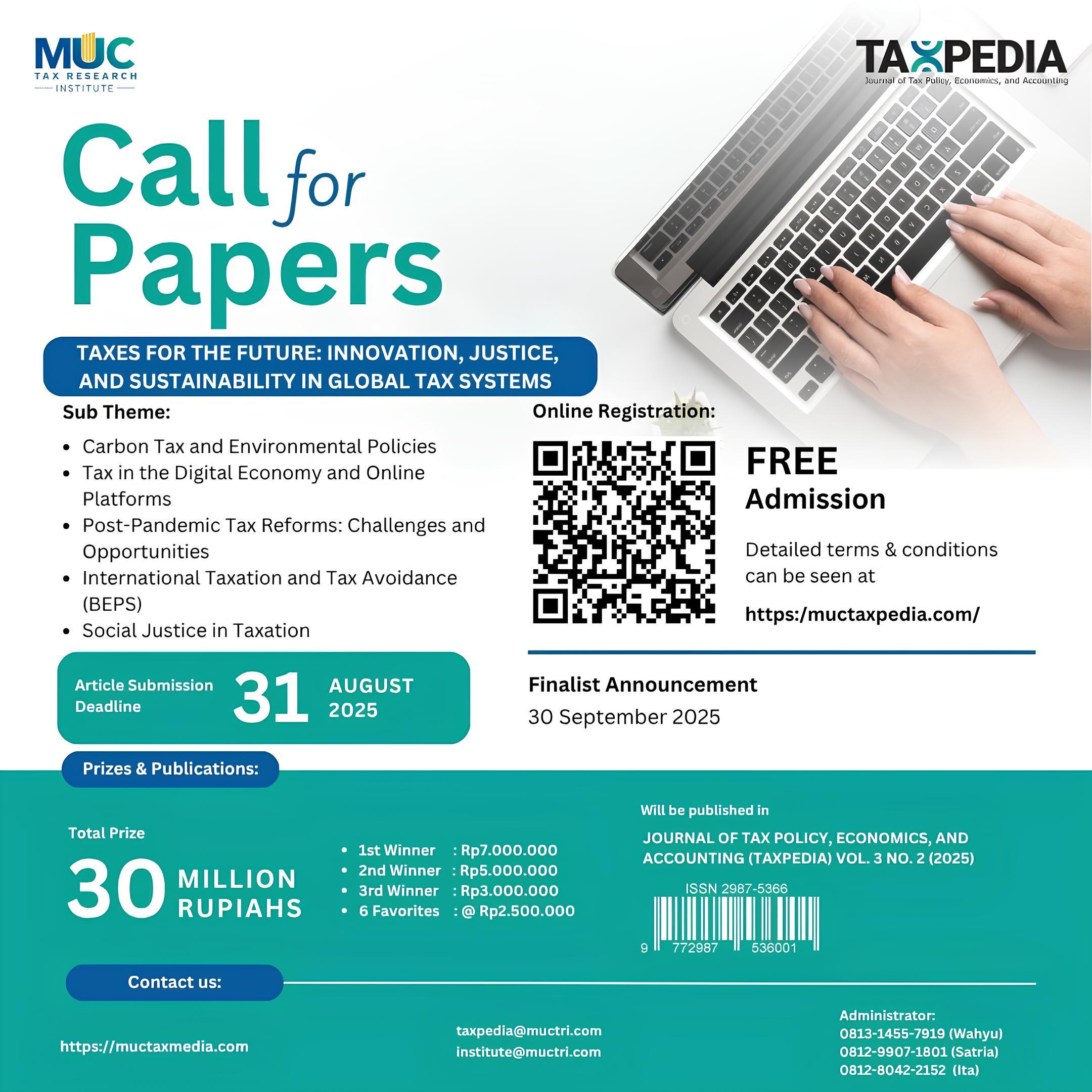

Call for paper 2025

Taxes for the Future: Innovation, Justice, and Sustainability in Global Tax Systems

The Journal of Tax Policy, Economics, and Accounting (TAXPEDIA) invites researchers, academics, practitioners, and tax enthusiasts to submit scholarly articles that contribute ideas on the latest issues in taxation. Accepted papers will be published in a special edition focusing on the following key themes:

- Carbon Tax and Environmental PoliciesThe implementation of carbon tax is a key instrument in the global effort to tackle climate change. However, its application faces various challenges, both economically, socially, and politically. We invite papers that address

- Carbon tax models and policies implemented in different countries

- The impact of carbon tax on the energy and industrial sectors

- The role of carbon tax in achieving climate change targets

- Equity and efficiency issues in the implementation of carbon tax

- Tax in the Digital Economy and Online PlatformsThe rapid digital transformation presents major challenges in taxation, especially related to platform-based online businesses. We seek papers that discuss:

- Tax policies for digital businesses and the platform economy

- Challenges in taxing cross-border transactions in the digital sector

- Efforts by countries to adapt their tax systems to the digital economy

- Issues of tax evasion and digital smuggling in the global economy

- Post-Pandemic Tax Reforms: Challenges and OpportunitiesThe COVID-19 pandemic has forced many countries to reform their tax policies. Relevant papers on this theme include:

- Tax policies introduced to respond to the economic impact of the pandemic

- The application of tax incentives to support economic recovery

- Tax policy changes for sectors most affected by the pandemic

- The future of taxation in the post-pandemic era

- International Taxation and Tax Avoidance (BEPS) With the globalization of the economy, cross-border tax avoidance has increased. We invite papers that discuss:

- The implementation of BEPS (Base Erosion and Profit Shifting) policies to tackle tax avoidance

- The impact of international tax policies on multinational corporations

- Strategies by countries to mitigate tax avoidance in global trade

- International collaboration in tax law enforcement

- Social Justice in TaxationA fair tax system plays a critical role in fostering social and economic equality. We invite papers that address:

- The impact of progressive tax policies on wealth distribution

- The relationship between tax systems and reducing social inequality

- Tax policies that support public welfare and sustainable economic development

- The role of taxation in enhancing social and economic inclusion for vulnerable groups

Submission Guidelines

- Register via Call for Paper form and register yourself as author on this website: https://muctaxpedia.com/.

- Formatting: The manuscript is written in English or Bahasa Indonesia, based on the manuscript template or TAXPEDIA writing guidelines.

- Submission Deadline: All papers must be submitted by 31 August 2025.

- Review Process: All submitted papers will undergo a rigorous peer-review process to ensure quality and originality.

- Submission: Papers should be submitted via the online submission system at https://muctaxpedia.com/.

Timetable

- Articles must be received no later than 31 August 2025. Announcement of winners will be on 30 September 2025, and the articles will be published in Journal of Tax Policy, Economic, and Accounting (TAXPEDIA) Volume 3 No. 2 (2025) on November 2025

Selection Criteria

- Originality and contribution to the advancement of tax knowledge.

- Relevance to the key themes outlined above.

- Depth of analysis and sustainability of the discussion on the chosen topic.

- Methodology used in the research or analysis.

- The manuscript is a result of empirical research or conceptual thinking and theoretical studies that have never been published or are not being processed by other journals.

- The manuscript is written in Indonesian or English, based on the manuscript template or TAXPEDIA writing guidelines.

- The manuscript can be written individually or in group (maximum 3 people).

- The submitted manuscript must be original, free from plagiarism or auto-plagiarism (maximum level of plagiarism is 20%), has never been published, and has never won another Call for Paper competition.

Publication and Awards

- Accepted papers will be published in a special edition of The Journal of Tax Policy, Economics, and Accounting (TAXPEDIA), to be published alternately in several editions.

- The editorial board will select 10 finalists and choose three best articles and six most favorite articles, with a TOTAL PRIZE OF Rp. 30 MILLION

- 1st Place : Rp7.000.000

- 2nd Place : Rp5.000.000

- 3rd Place : Rp3.000.000

- 6 Favorites : @ Rp2.500.000

- Other than the best and favorite articles, selected manuscripts could be published in the Journal of Tax Policy, Economic, and Accounting (TAXPEDIA) after review and/or revision process.

We look forward to receiving papers that contribute significantly to the field of taxation, especially in addressing the current and future challenges in global and national tax systems.

For inquiries, please contact:

- Wahyu (0813-1455-7919)

- Ita (0812-8042-2152)

- Satria (0812-9907-1801)